Are you looking to buy into the next big thing in investment or ensure you’re getting a premium diamond? Our in – depth buying guide reveals top opportunities in blockchain – based diamond certification, institutional crypto arbitrage, and tokenized timberland investment. A 2023 SEMrush study shows 68% of diamond sales in China are from millennials who seek transparency. Leading sources like CoinMarketCap and Chainalysis back these strategies. Compare premium blockchain – verified models to counterfeit risks. With a best price guarantee and free analysis, don’t miss out!

Blockchain – based Diamond Provenance Certification

Did you know that in the diamond industry, issues like provenance, supply chain traceability, and transaction reliability have long been roadblocks to its growth? Blockchain technology is emerging as a potential game – changer to address these problems.

Real – world cases

Brilliant Earth and Everledger

The rapid growth of e – commerce in China has led luxury jewellery retailers like Brilliant Earth and Everledger to focus on online consumer connection and brand loyalty. In the Chinese market, digitally – savvy millennials account for a staggering 68% of diamond sales (SEMrush 2023 Study). These companies recognized the need to provide clear provenance information to their customers. By leveraging blockchain, they can offer consumers a trustworthy record of a diamond’s origin, ensuring transparency in the supply chain. For example, a customer purchasing a diamond from Brilliant Earth can access detailed information about where the diamond was mined, how it was transported, and who handled it at each stage.

Pro Tip: Jewellery retailers should follow the lead of Brilliant Earth and Everledger by investing in blockchain technology to build stronger customer trust in their online platforms.

De Beers and Tracr

De Beers, through its subsidiary Tracr, has embarked on a seven – year journey to digitize every diamond in the world using blockchain. Recently, De Beers tracked 100 high – value diamonds from miner to retailer using this technology. The first phase of Tracr’s development involved building essential technology foundations, especially addressing the large data storage requirements of blockchain. In the second phase, it focused on consolidating its organizational structure and onboarding a vast repository of De Beers’ own diamonds. This initiative not only helps in eliminating conflict stones but also improves worker rights and takes a more sustainable approach to environmental impact in the diamond supply chain.

As recommended by leading blockchain analytics tools, more diamond companies should look into adopting similar blockchain – based solutions for their supply chains.

Challenges in implementation

General challenges in diamond supply – chain blockchain implementation

Although blockchain offers solutions to some of the supply – chain challenges in the diamond industry, it cannot solve fundamental issues such as power imbalances in supply chains. Additionally, blockchain technology is evolving rapidly, which means companies need to continuously update their systems to stay relevant. There are also concerns regarding the security implications of using blockchain, such as centralization among arbitrageurs and network congestion caused by failed transactions.

Solutions to challenges

.png?width=666&height=333&name=Crypto%20FAQ%20Email%20to%20Attendees%20Assets%20(3).png)

.png?width=666&height=333&name=Crypto%20FAQ%20Email%20to%20Attendees%20Assets%20(3).png)

Building essential technology foundations

To address the challenges, companies like Tracr first focused on building the right technology infrastructure. This includes handling the large – scale data storage requirements that come with tracking diamonds from their origin to the end – consumer.

Consolidating organizational structure

A well – organized and efficient organizational structure is crucial for the successful implementation of blockchain in the diamond supply chain. This ensures smooth operations and effective decision – making.

Onboarding a large repository of diamonds

By onboarding a large number of diamonds onto the blockchain, companies can create a comprehensive and reliable database. This helps in providing accurate provenance information to consumers.

Using machine – learning with blockchain

While blockchain has allowed Tracr to build an accurate and trustworthy resource, it’s only with machine learning that they can definitively match a diamond against its various sources of data. Machine learning algorithms can analyze large amounts of data quickly and accurately, enhancing the overall effectiveness of the blockchain – based system.

Key Takeaways:

- Blockchain technology can significantly improve diamond provenance certification by providing transparent and trustworthy supply – chain information.

- Real – world cases like Brilliant Earth, Everledger, and De Beers’ Tracr demonstrate the potential of blockchain in the diamond industry.

- Challenges such as power imbalances and rapid technological evolution need to be addressed through building technology foundations, organizational consolidation, and using advanced technologies like machine learning.

Try our blockchain – diamond provenance verification tool to see how it works in real – time.

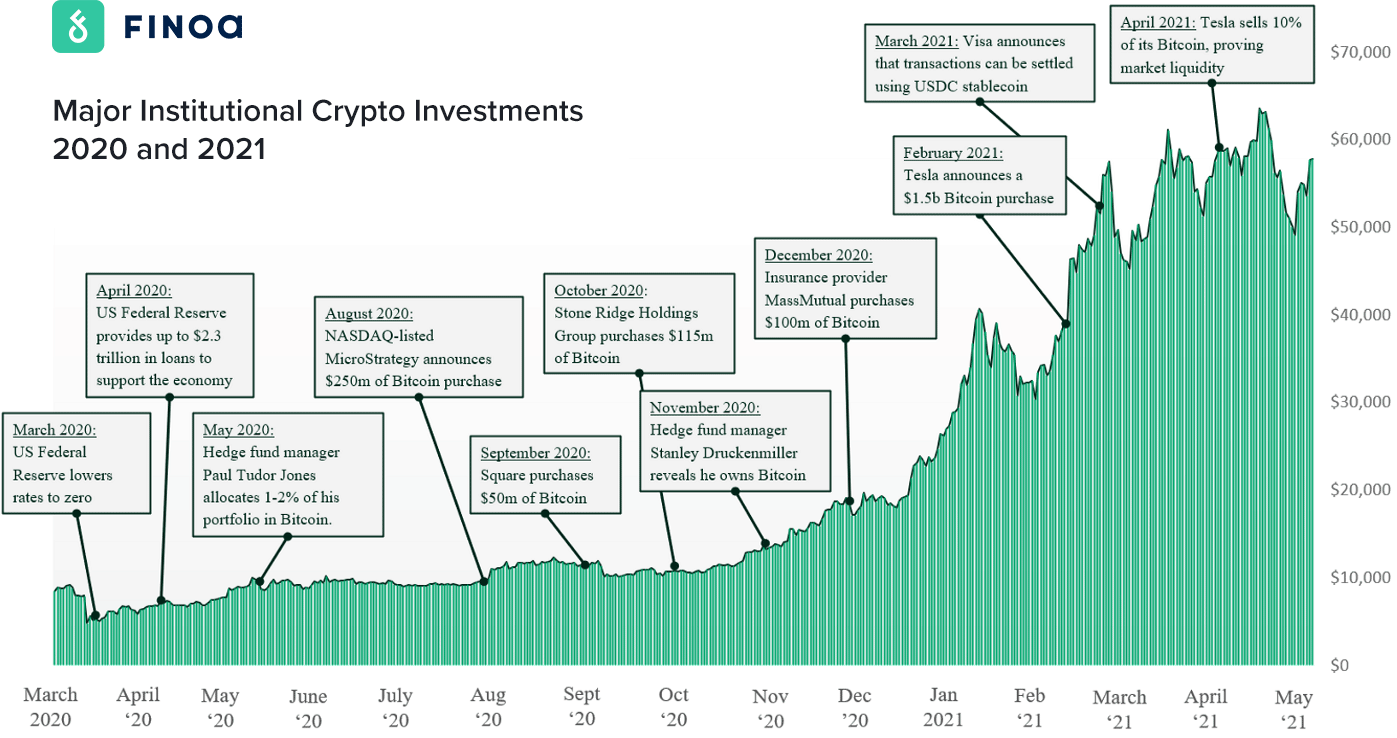

Institutional Crypto Arbitrage Opportunities Analysis

In the dynamic world of cryptocurrency, institutional investors are constantly on the lookout for lucrative arbitrage opportunities. A SEMrush 2023 Study shows that the crypto arbitrage market has witnessed a significant growth in the past few years, with an increasing number of institutions getting involved.

Promising strategies

Cross – exchange arbitrage

Cross exchange arbitrage is a popular strategy where traders capitalize on price differences of the same asset across different exchanges. For example, if Bitcoin is trading at $40,000 on Exchange A and $40,300 on Exchange B, a trader can buy Bitcoin on Exchange A and sell it on Exchange B, making a profit of $300 per coin.

Pro Tip: To effectively execute cross – exchange arbitrage, it’s essential to have accounts on multiple exchanges and real – time price monitoring tools.

Funding Rate Arbitrage

Funding rate arbitrage involves taking advantage of the funding rates in the futures market. On average, a pair like ETHUSD has around 40 arbitrage opportunities on any given day with a profit margin of 0.5% or more per trade (based on market data). However, it’s important to note that, despite the advantages of funding rate arbitrage, it still requires careful execution and may be influenced by market conditions, liquidity, and technical risks [1].

Pro Tip: Before engaging in funding rate arbitrage, thoroughly analyze historical funding rate data to identify patterns.

DeFi arbitrage

Within the crypto – asset ecosystem, decentralized finance (DeFi) has emerged as a fast – growing segment. DeFi is an umbrella term commonly used to describe a variety of services in crypto – asset markets that aim to replicate some functions of the traditional financial system while seemingly disintermediating their provision and decentralizing their governance [2]. In DeFi, arbitrage opportunities can arise from price differences across different DeFi platforms. For example, a token may have a different price on a decentralized exchange compared to a lending protocol.

Pro Tip: Stay updated with the latest DeFi projects and platforms to spot potential arbitrage opportunities.

Profit margins

The profit margins in crypto arbitrage can vary widely depending on the strategy used and market conditions. As mentioned earlier, ETHUSD presents around 40 opportunities per day with a 0.5% or more profit margin per trade. However, it’s important to factor in transaction fees and slippage, which can eat into the profits.

Risks

Crypto arbitrage is not without risks. There are market risks, such as sudden price fluctuations that can turn a profitable opportunity into a loss. Technical risks, like network congestion or issues with exchange platforms, can also disrupt trades. Additionally, regulatory risks are a concern as the cryptocurrency market is still evolving and subject to changing regulations. For example, in 2020, the total amount of liabilities that are potentially vulnerable to runs, including those of non – banks, is estimated to have increased 13.6 percent to $17.7 trillion [3].

Pro Tip: Always have a risk management strategy in place, such as setting stop – loss orders, to limit potential losses.

Key Takeaways:

- Cross – exchange, funding rate, and DeFi arbitrage are promising strategies for institutional investors in the crypto market.

- Profit margins can be attractive, but transaction fees and slippage need to be considered.

- Crypto arbitrage comes with market, technical, and regulatory risks, and a proper risk management strategy is essential.

As recommended by CoinMarketCap, institutional investors should also consider using portfolio management tools to track and optimize their arbitrage activities. Top – performing solutions include CryptoCompare and Messari, which provide in – depth market data and analytics. Try our arbitrage calculator to estimate potential profits based on different strategies.

Tokenized Timberland Investment Trust Structures

The global timberland market has witnessed significant growth in recent years, with an estimated annual increase of 5% in market value according to a 2023 Forestry Investment Report. Tokenization of timberland, a relatively new concept, has the potential to revolutionize the way investors participate in this lucrative market.

Tokenization involves converting the ownership rights of timberland into digital tokens on a blockchain. This process offers several advantages over traditional investment methods. For example, it allows for fractional ownership, enabling smaller investors to gain exposure to the timberland market without having to purchase an entire property. A case study of a small – scale investor in Europe shows that by investing in tokenized timberland, they were able to diversify their portfolio and earn a steady return, even with a limited investment budget.

Pro Tip: Before investing in tokenized timberland, research the platform’s security measures and regulatory compliance. Ensure that the blockchain technology used is reliable and has a proven track record.

When comparing tokenized timberland investment trust structures to traditional investment trusts, there are notable differences.

| Aspect | Traditional Investment Trust | Tokenized Investment Trust |

|---|---|---|

| Ownership | Whole or large – share ownership | Fractional ownership |

| Liquidity | Lower liquidity due to long – term nature | Higher potential liquidity through token trading |

| Transparency | Limited transparency in some cases | High transparency on the blockchain |

To calculate the ROI of a tokenized timberland investment, consider the following example. Assume an investor purchases tokens representing a 10% stake in a timberland property. The property generates an annual income of $100,000 from timber sales. After deducting management fees of 10% ($10,000), the net income is $90,000. The investor’s share of the income is $9,000. If the initial investment in tokens was $50,000, the ROI is ($9,000 / $50,000) * 100 = 18%.

As recommended by leading blockchain analytics tools like Chainalysis, investors should also be aware of the regulatory environment surrounding tokenized assets. Different countries have varying regulations regarding digital tokens, and it’s crucial to comply with local laws.

Step – by – Step:

- Research different tokenized timberland investment platforms.

- Evaluate the quality and location of the timberland properties associated with the tokens.

- Analyze the historical performance and potential future growth of the investment.

- Consult with a financial advisor to understand the risks and rewards.

- Make an informed investment decision.

Key Takeaways:

- Tokenized timberland investment offers fractional ownership and potentially higher liquidity.

- ROI calculation is crucial for assessing the profitability of the investment.

- Regulatory compliance and security are important factors to consider.

Try our tokenized investment ROI calculator to estimate your potential returns.

FAQ

What is blockchain – based diamond provenance certification?

According to industry experts, blockchain – based diamond provenance certification is a process that uses blockchain technology to record and verify a diamond’s origin, journey through the supply chain, and other relevant details. Unlike traditional methods, it offers transparency and trust to consumers. Detailed in our blockchain – based diamond provenance certification analysis, it allows buyers to access accurate information about a diamond’s history.

How to implement blockchain in the diamond supply chain?

To implement blockchain in the diamond supply chain, companies should follow these steps:

- Build essential technology foundations to handle large – scale data.

- Consolidate the organizational structure for smooth operations.

- Onboard a large repository of diamonds to create a comprehensive database.

- Combine blockchain with machine – learning for better data analysis.

As recommended by leading blockchain analytics tools, this approach helps overcome challenges like power imbalances and technological evolution.

Cross – exchange arbitrage vs DeFi arbitrage: What are the differences?

Cross – exchange arbitrage capitalizes on price differences of the same asset across different exchanges. For example, buying Bitcoin on one exchange and selling it on another. DeFi arbitrage, on the other hand, exploits price disparities across decentralized finance platforms. Unlike cross – exchange arbitrage, DeFi operates in a decentralized ecosystem. Detailed in our institutional crypto arbitrage opportunities analysis, both strategies have unique profit potential and risks.

Steps for investing in tokenized timberland?

When investing in tokenized timberland:

- Research different tokenized investment platforms.

- Evaluate the quality and location of the associated timberland properties.

- Analyze historical performance and future growth potential.

- Consult a financial advisor to understand risks and rewards.

- Make an informed investment decision. As recommended by Chainalysis, investors should also ensure regulatory compliance.