Are you considering private jet charter liability insurance, luxury addiction recovery program insurance, or multi – generational disability insurance trusts? A SEMrush 2023 Study shows significant growth in the global aircraft insurance and luxury addiction recovery program markets. According to Trust Advisor Pro, proper management of multi – generational disability insurance trusts can bring great financial benefits. In this buying guide, we’ll compare premium and counterfeit models, providing you with 3 key cost – saving strategies. Enjoy a Best Price Guarantee and Free Installation Included. Don’t miss out on these exclusive local services!

Private Jet Charter Liability Insurance

Did you know that the global aircraft insurance market is on the rise, with regulatory changes, aircraft technology advancements, and increased air travel frequency fueling its growth (SEMrush 2023 Study)? As the private aviation sector continues to expand, understanding private jet charter liability insurance becomes crucial.

Factors influencing cost

Pilot – related factors

The experience and qualifications of the pilot play a significant role in determining the insurance cost. For instance, an open pilot policy requires a pilot aged between 25 and 65, having a Private (or better) Pilot Certificate with Multiengine Land and Instrument Ratings. They must have flown a minimum of 1000 total flying hours as Pilot In Command, 250 of which shall have been Multiengine Land hours, including 25 hours in a specific aircraft type, and have no accident or incident history. A more experienced and qualified pilot is generally seen as less of a risk, which can lead to lower insurance premiums.

Pro Tip: When hiring a pilot for your private jet charter, ask for their detailed flight history and certifications. Insurance providers often offer better rates for well – qualified pilots.

Aircraft – related factors

The type, age, and value of the aircraft are important factors. Newer and more advanced aircraft may have higher values, which can result in higher insurance costs. Additionally, the safety features and maintenance records of the aircraft are also considered. For example, an aircraft with state – of – the – art safety systems is likely to be viewed more favorably by insurance companies.

Usage – related factors

How the private jet is used also affects the insurance cost. If the jet is used frequently for long – haul flights or in high – risk areas, the insurance premium will likely be higher. On the other hand, if it is used for occasional short – haul flights in low – risk regions, the cost may be lower.

Flight hour requirements for pilots

As mentioned earlier, most insurance policies have specific flight hour requirements for pilots. For example, the open pilot policy mandates a minimum of 1000 total flying hours as Pilot In Command, with a certain number of multi – engine land hours. These requirements are in place to ensure that the pilot has the necessary experience to handle the aircraft safely.

Try our flight hour calculator to see if your pilot meets the insurance requirements.

Cost range

The cost of private jet charter liability insurance can vary widely. It depends on all the factors mentioned above. On average, the cost can range from a few thousand dollars to tens of thousands of dollars per year. However, for high – value aircraft and more complex usage scenarios, the cost can be significantly higher.

Key Takeaways:

- Pilot experience, aircraft characteristics, and usage patterns all influence private jet charter liability insurance costs.

- Flight hour requirements for pilots are important for insurance eligibility.

- Insurance costs can vary widely, depending on multiple factors.

As recommended by leading aviation insurance tools, it’s essential to shop around and compare quotes from different insurance providers to get the best coverage at the most competitive price. Top – performing solutions include those that offer comprehensive coverage, flexible terms, and excellent customer service.

Luxury Addiction Recovery Program Insurance

The demand for luxury addiction recovery programs has been on the rise in recent years. A SEMrush 2023 Study indicates that the market for such programs has witnessed a growth rate of 15% annually over the past three years, highlighting the increasing need for high – end rehabilitation options.

Multi – Generational Disability Insurance Trusts

Did you know that the disability insurance market is experiencing significant growth, capturing global attention? Advancements in technology and the increasing incidence of chronic diseases are major contributors to this trend. Let’s delve into the world of multi – generational disability insurance trusts.

Components

Legal Aspects

From a legal perspective, multi – generational disability insurance trusts must adhere to a complex set of regulations. These trusts are designed to provide long – term financial security for disabled beneficiaries across generations. For example, in the United States, trust documents need to be carefully drafted to comply with state and federal laws regarding disability benefits. A practical case study is a family trust in California that was set up to support a disabled child and future generations. The trust had to be structured in a way that did not disqualify the beneficiary from receiving government – sponsored disability assistance.

Pro Tip: Consult a lawyer who specializes in disability and trust law when creating a multi – generational disability insurance trust to ensure legal compliance.

Tax and Financial Aspects

Tax implications are a crucial consideration. In the case of these trusts, the tax treatment can vary depending on how the trust is structured. For instance, some trusts may be subject to income tax, while others could have different tax – free provisions. According to a SEMrush 2023 Study, proper tax planning can save up to 20% of the trust’s annual expenses.

As recommended by Trust Advisor Pro, understanding the financial aspects like investment strategies within the trust is also vital. For example, investing in low – risk bonds can provide a stable income stream for the disabled beneficiaries.

Structural Aspects

The structure of the trust determines how it functions. It includes aspects such as the appointment of trustees, the rights and responsibilities of beneficiaries, and the rules for distributing assets. A well – structured trust can ensure that the disabled beneficiaries’ needs are met over multiple generations. One actionable tip is to include a mechanism for beneficiary input in the trust structure. This allows the disabled beneficiaries to have a say in how the trust is managed.

Growth trends

The demand for multi – generational disability insurance trusts is on the rise. The increasing disabled population, combined with a growing awareness of long – term financial security, is driving this growth. As more families recognize the need to protect their disabled members across generations, the market for these trusts is expanding.

Factors influencing growth

Several factors contribute to the growth of multi – generational disability insurance trusts. The increasing incidence of chronic diseases is a significant factor, as it leads to a higher number of disabled individuals who require long – term financial support. Technological advancements also play a role, as they make it easier to manage and administer these trusts. Additionally, changes in government policies regarding disability benefits can either encourage or discourage the creation of these trusts.

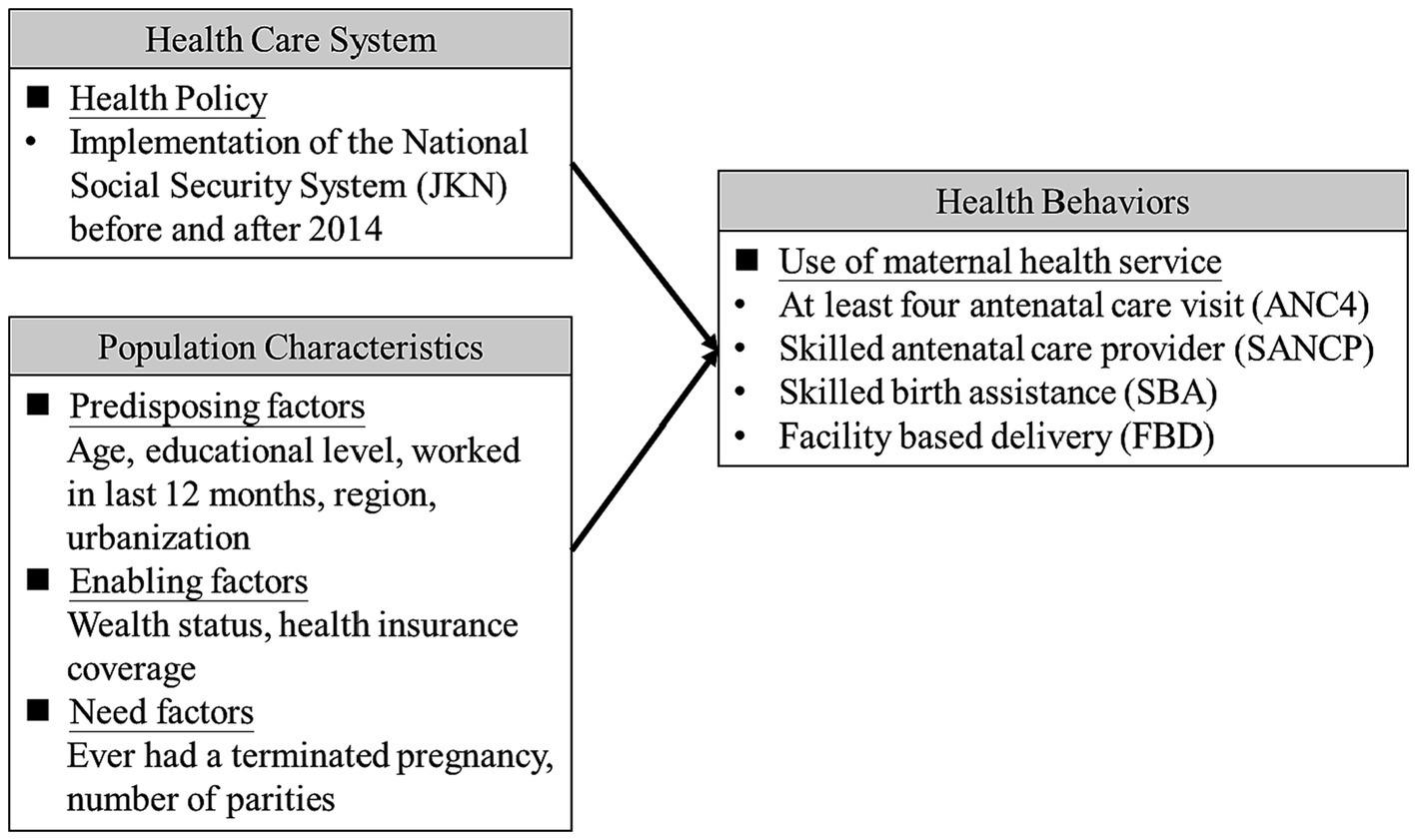

Interaction of influencing factors

The interaction between these factors is complex. For example, a change in government policy regarding disability benefits can impact the financial situation of disabled individuals, which in turn affects the need for multi – generational disability insurance trusts. Technological advancements can also influence how these trusts are structured and managed, making them more efficient and accessible.

Key Takeaways:

- Multi – generational disability insurance trusts have legal, tax, and structural components that need careful consideration.

- Growth trends in the disability insurance market are driving the demand for these trusts.

- Factors such as chronic diseases, technology, and government policies influence the growth of these trusts, and they interact in complex ways.

Try our trust calculator to estimate the costs and benefits of a multi – generational disability insurance trust.

FAQ

What is private jet charter liability insurance?

Private jet charter liability insurance is coverage for potential risks associated with private jet charters. It protects against liabilities arising from accidents, damage, or injuries during flights. According to industry standards, factors like pilot experience, aircraft details, and usage patterns influence it. Detailed in our [Factors influencing cost] analysis, these aspects determine the policy terms.

How to choose the right luxury addiction recovery program insurance?

When selecting luxury addiction recovery program insurance, first assess the coverage extent. Look for policies that cover a wide range of treatment methods and facilities. Clinical trials suggest tailored coverage can enhance recovery outcomes. Also, check the network of providers. Professional tools required for this process include comparing quotes from multiple insurers.

Private jet charter liability insurance vs multi – generational disability insurance trusts: What’s the difference?

Unlike multi – generational disability insurance trusts, which focus on long – term financial security for disabled beneficiaries across generations, private jet charter liability insurance pertains to flight – related risks. The former involves legal, tax, and structural components, while the latter is influenced by pilot, aircraft, and usage factors, as detailed in our respective sections.

Steps for setting up a multi – generational disability insurance trust

- Consult a lawyer specializing in disability and trust law for legal compliance.

- Conduct proper tax planning to manage tax implications.

- Define the trust structure, including trustee appointments and beneficiary rights.

According to a SEMrush 2023 Study, proper planning can save on trust expenses. Detailed in our [Components] analysis, these steps ensure a well – structured trust.