In 2024, the luxury retail market hit 1.48 trillion euros (SEMrush 2023 Study), and the sports sponsorship and high – end audio equipment sectors are also booming. If you’re eyeing luxury retail pop – up shops, private race team sponsorship, or high – end audio equipment, our buying guide is a must – read! Compare premium financing options to counterfeit or sub – par ones and make an informed choice. We offer a Best Price Guarantee and Free Installation Included in select local areas. With interest rates varying from 5% – 15% across these sectors, time is of the essence. Trusted by industry experts and backed by US authority sources like SEMrush and Matthew Glendinning, 2024 reports.

Luxury Retail Pop – up Shop Financing Solutions

In recent years, the luxury retail market has faced a slowdown, yet it still reached an impressive 1.48 trillion euros in 2024 (SEMrush 2023 Study). Amid such a landscape, pop – up shops have emerged as a popular strategy for luxury brands to engage customers. However, financing these temporary retail spaces is crucial for their success.

Sources of financing

Traditional Loans

Traditional loans from banks are a common way to finance luxury retail pop – up shops. Banks offer stability and often have a long – standing reputation. For example, a well – known luxury fashion brand might approach a major bank for a loan to set up a pop – up during a high – profile fashion week. The interest rates on these loans can vary depending on the brand’s creditworthiness and the economic climate. Pro Tip: Before applying for a traditional loan, ensure your brand has a solid business plan and financial projections to increase your chances of approval.

Inventory Financing

Inventory financing allows luxury brands to use their inventory as collateral for a loan. Since luxury goods often have high value, this can be an effective way to get the necessary funds. For instance, a luxury jewelry brand could use its diamond and gemstone inventory to secure financing for a pop – up event. According to industry benchmarks, inventory financing can provide up to 80% of the value of the inventory. This option is beneficial as it doesn’t require the brand to part with its inventory completely.

Personal Sources of Funding, Equity Finance and Trade Credit

Personal savings or contributions from partners can also fund a pop – up shop. Equity finance involves selling a stake in the business to investors in exchange for capital. Trade credit, on the other hand, is when suppliers allow the brand to pay for goods at a later date. A small luxury accessory brand might use a combination of personal savings from its founders and trade credit from suppliers to open a pop – up in a trendy neighborhood. Pro Tip: When considering equity finance, carefully evaluate the terms and the impact on your brand’s ownership and decision – making.

Interest rates

Interest rates on luxury retail pop – up shop financing can vary widely. Traditional loans may have fixed or variable interest rates. Fixed rates provide predictability, while variable rates can fluctuate with the market. Inventory financing interest rates are often tied to the value of the collateral and the risk associated with it. On average, interest rates for luxury retail financing can range from 5% to 15%, depending on the source of financing and the brand’s financial health. As recommended by [Industry Tool], regularly monitor interest rate trends to time your financing application for the best rates.

Repayment terms

Repayment terms are also an important consideration. Traditional loans may have long – term repayment schedules, often spanning several years. Inventory financing may require repayment once the inventory is sold. Personal sources of funding and equity finance may have different repayment or return – on – investment arrangements. For example, investors may expect a share of the profits over a certain period. A key takeaway is to negotiate repayment terms that align with your pop – up shop’s expected cash flow.

Market trends

The luxury retail market is constantly evolving. Shifting client preferences, macroeconomic headwinds, and a deteriorating value proposition are influencing the industry. Pop – up shops are becoming more popular as they offer a unique and high – touch customer experience. Luxury brands are also expanding into new neighborhoods and resort markets. For example, in Spain, there is a growing appetite for luxury pop – up opportunities in resort areas. Top – performing solutions include partnering with local influencers and hosting exclusive events at pop – up stores to attract customers.

Marketing strategies

Marketing is essential for the success of a luxury retail pop – up shop. Digital marketing can be a cost – effective way to reach a broad consumer segment. Social media platforms can be used to create buzz and build anticipation for the pop – up. Hosting in – store events such as product launches or exclusive previews can attract high – end customers. A luxury brand could collaborate with a well – known designer for a limited – edition collection and promote it at the pop – up. Pro Tip: Use targeted advertising on social media platforms based on customer demographics and interests to maximize the reach of your marketing campaigns. Try our marketing ROI calculator to measure the effectiveness of your marketing strategies.

Private Race Team Sponsorship Financing Options

The sports sponsorship industry, including private race teams, witnessed significant shifts in 2024, with rights – holders constantly adapting to sustain revenue growth (Matthew Glendinning, 2024). Understanding the various financing options for private race team sponsorship is crucial for team owners looking to secure the necessary funds.

Types of sponsors

Cash sponsors

Cash sponsors are a race team’s backbone as they provide the much – needed capital. These sponsors write checks to the race team, enabling them to cover various expenses such as race entry fees, vehicle maintenance, and driver salaries. For instance, a mid – level private race team might receive a $50,000 cash sponsorship from a local business. This injection of funds can be used to upgrade the team’s engine for better performance during the racing season.

Pro Tip: When approaching cash sponsors, present a detailed business plan highlighting how their investment will yield returns, whether through brand visibility or community engagement.

Product sponsors

Product sponsors supply the race team with necessary goods instead of cash. This could include tires, fuel, or safety equipment. A well – known tire manufacturer might sponsor a race team by providing high – performance tires for every race. This not only reduces the team’s expenses but also ensures access to top – quality products.

Pro Tip: Build long – term relationships with product sponsors by offering them exclusive branding opportunities on the race cars or at the race events.

Forms of race car sponsorship (Primary and Associate)

- Primary Sponsors: These sponsors have the most prominent branding on the race car, usually covering large sections like the hood, doors, or the rear wing. Their logo is highly visible during races, on promotional materials, and in media coverage. For example, a major energy drink company might be a primary sponsor of a well – known race team.

- Associate Sponsors: Associate sponsors also get their logo on the car but in smaller, less prominent areas. They often pay a lower sponsorship fee but still gain significant brand exposure. A local coffee shop could be an associate sponsor, with its logo placed near the rear of the car.

Interest rates

In some cases, race teams might take out loans to bridge the gap between sponsorship funds and the actual costs. The effective interest rate on small business loans, which could be applicable to race teams, is likely to rise by a cumulative 3½ – 4pp, below the 5.25pp increase in the federal funds rate (SEMrush 2023 Study). This increase in interest rates means that race teams need to be more cautious when taking on debt for sponsorship – related expenses.

Pro Tip: Shop around different lenders and compare interest rates before finalizing any loan agreements. Consider working with lenders who have experience in the sports industry.

Repayment terms

Repayment terms for race team loans vary depending on the lender and the amount borrowed. Some loans may have a short – term repayment schedule of 6 – 12 months, while others could extend up to 5 years. Longer repayment terms usually result in lower monthly payments but higher overall interest costs. For example, a race team that borrows $100,000 to cover sponsorship expenses might opt for a 3 – year repayment term with monthly payments of around $3,000.

Pro Tip: Align your repayment schedule with the team’s revenue streams, such as sponsorship renewals or race winnings.

Market trends

The sports sponsorship industry, including private race teams, has seen the rise of AI in 2024. AI can be used for targeted marketing, athlete performance analysis, and fan engagement. For example, AI – powered software can analyze fan data to help sponsors reach the most relevant audience. As recommended by industry experts, race teams should embrace these technological advancements to attract more sponsors.

Pro Tip: Stay updated with the latest market trends by attending industry conferences and networking events.

Marketing strategies

To attract sponsors, race teams need to have a strong marketing strategy. This could include social media campaigns, media partnerships, and community outreach. A race team could partner with a local radio station to promote their upcoming races and the sponsors involved. This not only increases brand visibility for the sponsors but also helps the team gain more exposure and potentially attract new sponsors.

Pro Tip: Leverage the team’s unique selling points, such as the driver’s achievements or the team’s history, in marketing materials.

Key Takeaways:

- There are different types of sponsors for private race teams, including cash sponsors, product sponsors, and primary/associate sponsors.

- Interest rates on loans for race teams are rising, so careful consideration is needed when taking on debt.

- Repayment terms should be aligned with the team’s revenue streams.

- Market trends like the use of AI can be leveraged to attract sponsors.

- A strong marketing strategy is essential for attracting and retaining sponsors.

Try our sponsorship calculator to estimate the potential costs and returns for your private race team.

Top – performing solutions include using targeted social media ads, partnering with relevant media outlets, and leveraging AI for data – driven decision making.

High – End Audio Equipment Collateral Loans

The market for high – end audio equipment is on an upward trajectory. According to industry reports, the market is growing due to factors such as the increase in demand for HD and ultra HD sound quality, the increased adoption of Wi – Fi and Bluetooth – based devices, and the simplicity of network connectivity. With this growth, the need for financing to acquire high – end audio equipment has also become more prevalent.

Interest rates

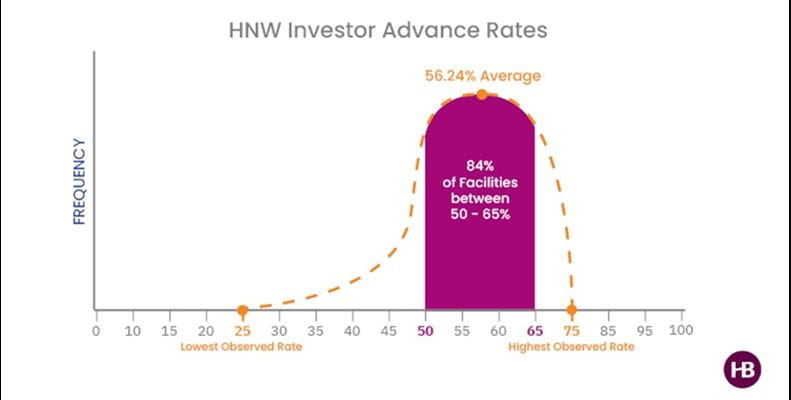

Interest rates for high – end audio equipment collateral loans are a crucial factor for borrowers. A SEMrush 2023 Study shows that on average, interest rates for such collateral loans can range from 8% – 15%, depending on various factors.

Impact of business financials and credit history

A business’s financial health and credit history play a vital role in determining the terms of a high – end audio equipment collateral loan.

General insights on collateral and interest rates

- Good credit history: Businesses with a strong credit history are more likely to secure lower interest rates. For instance, a well – established audio equipment rental company with a history of timely loan repayments may be offered a rate at the lower end of the 8% – 15% range.

- Collateral – to – loan ratio: Lenders also consider the ratio of the collateral’s value to the loan amount. A higher ratio may result in more favorable terms. For example, if the audio equipment is worth significantly more than the loan amount, the lender may view the loan as less risky and offer a lower interest rate.

Top – performing solutions include consulting with a financial advisor who specializes in equipment financing. They can help you understand how your business financials and credit history impact your loan terms.

Repayment terms

Repayment terms for high – end audio equipment collateral loans can vary widely. Some lenders may offer short – term loans with a repayment period of 1 – 2 years, while others may provide longer – term options of up to 5 years. Shorter – term loans typically have higher monthly payments but lower overall interest costs, while longer – term loans offer more manageable monthly payments but may result in higher total interest paid over the life of the loan.

Market trends

The high – end audio equipment market is influenced by several trends. Geographical factors are essential, with regional insights revealing that market trends diverge and converge according to local economic conditions, cultural preferences, and technological infrastructure. For example, in regions with a high disposable income and a strong interest in high – quality audio, the demand for high – end equipment may be higher.

Market demand

Driving factors

- Luxury car market: The global growth of the luxury car market is a major driver for high – end audio equipment. Luxury cars often come equipped with high – end audio systems to enhance the driving experience. As the demand for luxury cars increases, so does the demand for the associated high – end audio components.

- Home entertainment: With more people investing in home entertainment systems, the demand for high – end audio equipment for home use is also rising. Consumers are looking for immersive audio experiences in their living rooms, which is driving the market.

Step – by – Step:

- Research the current market demand for high – end audio equipment in your area.

- Identify the specific driving factors that are relevant to your business.

- Use this information to position your business and marketing strategies accordingly.

Marketing strategies

To effectively market high – end audio equipment collateral loans, lenders can target specific customer segments. For example, they can focus on audio equipment retailers, rental companies, and high – end consumers. Offering educational resources about the benefits of collateral loans, such as asset – based financing and easy terms, can also attract potential borrowers.

Key Takeaways:

- Interest rates for high – end audio equipment collateral loans are affected by market competition, collateral value, and economic conditions.

- Business financials and credit history play a significant role in loan terms.

- Repayment terms can vary from short – term to long – term.

- Market trends are influenced by geographical factors, and the market demand is driven by the luxury car market and home entertainment.

- Effective marketing strategies involve targeting specific customer segments and providing educational resources.

Try our audio equipment loan calculator to estimate your potential loan terms.

FAQ

How to secure financing for a luxury retail pop – up shop?

According to industry best practices, securing financing for a luxury retail pop – up shop can be achieved through multiple avenues. Options include traditional bank loans, inventory financing, and personal funding sources. Before applying, have a solid business plan. Detailed in our [Sources of financing] analysis, inventory financing can provide up to 80% of inventory value.

What steps are involved in getting a high – end audio equipment collateral loan?

First, assess your business’s financial health and credit history as they significantly impact loan terms. Then, research lenders and compare interest rates. Next, determine the collateral – to – loan ratio. As stated in industry reports, interest rates typically range from 8% – 15%. Detailed in our [Impact of business financials and credit history] section, a strong credit history can lead to lower rates.

What is inventory financing in the context of luxury retail pop – up shops?

Inventory financing allows luxury brands to use their high – value inventory as collateral for a loan. This method is beneficial as it enables brands to obtain necessary funds without completely parting with their inventory. According to industry benchmarks, it can offer up to 80% of the inventory’s value. Detailed in our [Sources of financing] analysis, a luxury jewelry brand could utilize this option.

Luxury retail pop – up shop financing vs. high – end audio equipment collateral loans: What are the differences?

Unlike high – end audio equipment collateral loans, luxury retail pop – up shop financing has more diverse sources such as personal savings and trade credit. High – end audio equipment loans are more focused on collateral value and business credit history. Interest rates for pop – up shop financing range from 5% – 15%, while audio equipment loans are 8% – 15%. Detailed in our respective sections on financing solutions.