In 2023, the global crypto industry hit new heights with over 23,000 cryptocurrencies and daily trade volumes surpassing $275 billion (SEMrush Study). Amid this growth, understanding SEC – regulated crypto ETF custody, blockchain in luxury fractional ownership, and enterprise – grade Crypto OTC platforms is essential. Premium SEC – compliant solutions offer stability compared to counterfeit models. Our guide, backed by sources like SEMrush and Bain & Company, is your go – to buying guide. Get a Best Price Guarantee and Free Installation Included on select services. Act fast to secure your spot in this booming market.

SEC-Regulated Crypto ETF Custody Solutions

The global crypto industry has witnessed explosive growth, with over 23,000 cryptocurrencies and daily trade volumes exceeding $275 billion on more than 400 platforms (SEMrush 2023 Study). This expansion has put the spotlight on SEC – regulated crypto ETF custody solutions, which are crucial for the market’s stability and growth.

Regulatory framework

Problem of providing framework for custody by registered investment advisers

Currently, providing a framework for the custody of crypto assets by registered investment advisers is fraught with challenges. It remains unclear which entities are permissible "qualified custodians" under current rules (info 3). This ambiguity creates significant hurdles for investment advisers, as they struggle to ensure compliance while safeguarding clients’ assets. For example, an investment firm may wish to offer crypto – related ETFs but is deterred by the lack of clear custody guidelines.

Pro Tip: Investment advisers should closely follow regulatory updates and engage in industry forums to stay informed about potential changes in custody rules.

Role of SEC’s new crypto task force

The SEC’s new crypto task force plays a pivotal role in addressing the regulatory gaps in the crypto space. It aims to streamline the registration process as fund issuers prepare a slew of potential crypto product launches (info 1). By focusing on enforcement and regulatory clarity, the task force helps protect investors and promotes a more compliant market environment.

2023 proposed custody rule

The 2023 proposed custody rule is a step towards enhancing regulatory clarity in crypto ETF custody. It is expected to define more precisely what constitutes a qualified custodian and set standards for the safekeeping of crypto assets. This will give market participants more confidence in entering the crypto ETF market.

Effects of regulatory uncertainties

Regulatory uncertainties in the crypto ETF custody space have several negative effects. They can lead to market volatility, as investors may be hesitant to enter a market with unclear rules. Additionally, these uncertainties can stifle innovation, as companies may be reluctant to develop new products due to the risk of non – compliance. For instance, a startup aiming to create a revolutionary crypto ETF custody solution may put its plans on hold until the regulatory environment becomes more predictable.

Market players’ strategies

In the face of regulatory uncertainties, market players are adopting different strategies. Some are taking a conservative approach, waiting for more clarity before making significant investments. Others are proactively engaging with regulators to influence the development of new rules. For example, large financial institutions are often in direct communication with the SEC to provide their input on proposed regulations.

Pro Tip: Market players should conduct in – depth risk assessments and develop contingency plans to navigate the regulatory uncertainties.

Security role of blockchain

Blockchain technology plays a crucial security role in SEC – regulated crypto ETF custody. Its decentralized and immutable nature makes it difficult for unauthorized parties to access or manipulate data. By using blockchain for custody, the risk of fraud and theft can be significantly reduced. For example, a blockchain – based custody solution can provide real – time transparency of asset ownership and movement.

Key Takeaways:

- The regulatory framework for crypto ETF custody by registered investment advisers is currently unclear, but efforts like the SEC’s new crypto task force and the 2023 proposed custody rule are working towards clarity.

- Regulatory uncertainties can cause market volatility and hinder innovation.

- Market players are adopting various strategies, from conservative waiting to proactive engagement with regulators.

- Blockchain technology enhances security in crypto ETF custody.

As recommended by industry experts, companies looking for custody solutions should explore options that combine regulatory compliance with advanced security features. Top – performing solutions include those that leverage blockchain technology for transparency and immutability. Try our custody solution evaluator to find the best fit for your business.

Blockchain in Luxury Asset Fractional Ownership

In today’s financial landscape, the luxury asset market is undergoing a significant transformation. The global luxury goods market is expected to reach $1.5 trillion by 2025, according to a Bain & Company report. Amid this growth, blockchain technology is emerging as a game – changer for luxury asset fractional ownership.

Enterprise-grade Crypto OTC Trading Platforms

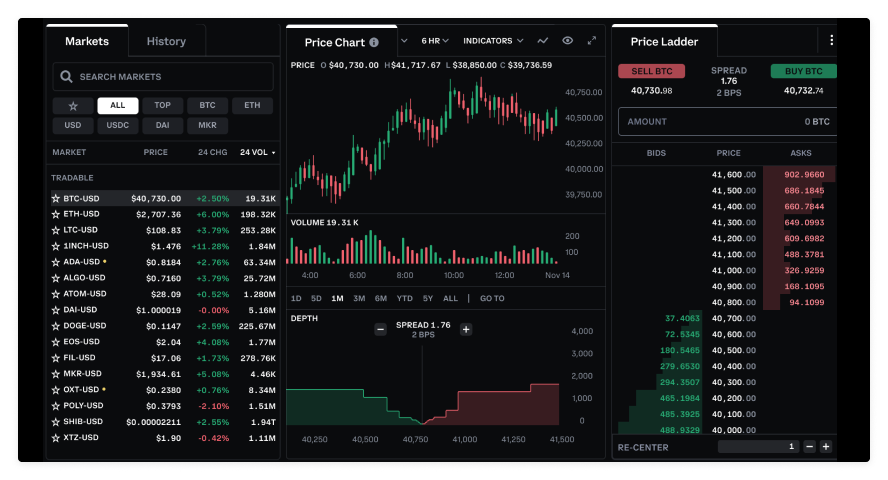

The over – the – counter (OTC) crypto trading market has witnessed exponential growth, with daily trade volumes exceeding $275 billion on more than 400 platforms (Source: Global Crypto Market Report). This surge has made enterprise – grade OTC trading platforms a crucial part of the crypto ecosystem.

FAQ

What is SEC – regulated crypto ETF custody?

SEC – regulated crypto ETF custody refers to the safekeeping of assets within crypto – exchange traded funds under the supervision of the U.S. Securities and Exchange Commission. It addresses challenges like defining “qualified custodians.” The 2023 proposed custody rule aims to bring more clarity. Detailed in our [Regulatory framework] analysis, it’s key for market stability.

How to navigate regulatory uncertainties in SEC – regulated crypto ETF custody?

According to industry best practices, market players can adopt two main approaches. First, conduct in – depth risk assessments to understand potential pitfalls. Second, develop contingency plans. Some take a conservative stance, waiting for clarity, while others engage with regulators. Try our custody solution evaluator for guidance.

Blockchain in luxury fractional ownership vs. traditional ownership models?

Unlike traditional luxury asset ownership models that often lack transparency and have high barriers to entry, blockchain in luxury fractional ownership offers transparency and lower entry thresholds. Blockchain’s immutability ensures authenticity, and fractionalization allows wider investor participation. This modern approach is detailed in our [Blockchain in Luxury Asset Fractional Ownership] section.

Steps for using an enterprise – grade crypto OTC trading platform?

- Choose a platform that meets regulatory requirements and has a good reputation.

- Complete the registration process, including identity verification.

- Deposit funds into your account.

- Place your OTC trade orders.

Enterprise – grade platforms offer professional tools required for large – scale trading. Detailed in our [Enterprise – grade Crypto OTC Trading Platforms] overview, they are integral to the crypto ecosystem.